Partnership for Long Term Care

Asset protection from Medicaid.

The goal of The Partnership for Long Term Care is to protect citizens from being forced to spend everything they have worked for on long term care, to prevent or delay dependence on Medicaid, and to protect their assets from Medicaid estate recovery.

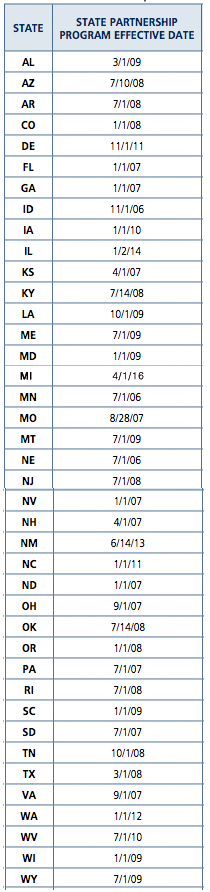

Only traditional long term care insurance qualifies for Partnership asset protection. Group long term care insurance, bought via employer, retirement or alumni associations do not qualify for Partnership. Life/LTC and Annuity/LTC also do not qualify, neither do older policies sold before your state adopted Partnership (see state chart below).

Section 6021 of the DRA (2005 Deficit Reduction Act.pdf) allows for Qualified State LTC Partnerships, which will permit States with approved State plan amendments (SPA) to exclude from estate recovery the amount of LTC benefits paid under a qualified LTC insurance policy.

For States that elect this option, the State plan must provide that, in determining eligibility for Medicaid, an amount equal to the benefits paid under a qualified LTC policy is disregarded. The State must also allow, in the determination of the amount to be recovered from a beneficiary's estate, for the same amount to be disregarded.

If you already bought a policy how do you know if it is Partnership or not?

States that have had Partnership since 1990s: CA, CT, IN, NY.

Your CA, CT, IN, NY policy will say Partnership or not.

Non-Partnership states: AK, HI, MA, MS, UT, VT

To find out if your policy is Partnership contact your insurance company directly.

Genworth: 800-456-7766

John Hancock: 800-270-1700

MedAmerica: 800-724-1582

MetLife: 800-308-0179

Mutual of Omaha: 800-693-6083

We do not have information about your policy.

You will need: policyholder name, policy number or social security number.

Partnership States Since 2006

With Policies Available

Partnership for Long Term Care Policies

The Partnership for Long Term Care program works in cooperation with private insurance companies. These companies have agreed to offer high quality policies that must meet stringent requirements set by the State Insurance Department and/or the Department of Health Services. These special policies are called "Partnership policies".

A Partnership policy cost the same as a non-Partnership yet provides additional benefits such as "asset protection" assuring that catastrophic long term care expenses won't reduce you to poverty even if you run out of insurance benefits.

A part of Medicaid is called Medicaid Estate Recovery. This is where the state office can examine your records to see if you have transferred any assets to avoid spending them for your care. In most states there is a 60 month "look back" period, which means if you transfer your assets today the state can "look back" 60 months to see if any have been transfered and "attach a lien" those assets to repay Medicaid for your care.

A Partnership LTC policy also means the state will no longer come after your estate for repayment (estate recovery).

The lifetime asset protection provided by a Partnership policy basically says that for every dollar of insurance money that is spent for your care, you get to keep an equal amount and still qualify for Medicaid.

Rather than having to spend down your assets to the poverty level of $2,000* you get to keep as much money as your policy paid out plus the $2,000* everyone else gets to keep.

If your policy spent $200,000 for your care and you ran out of insurance money but still needed care you could keep $200,000 and then Medicaid would pay. Wouldn't your quality of life be better with $200,000 in cash than with only $2,000*?

And the Partnership policy provides estate recover exemption. Your estate will no longer have to repay Medicaid for any costs for your care.

The Partnership policy can be considered a higher quality product than a non-Partnership because of the state requirements for companies to participate.

The requirements the consumer has to meet for their policy to qualify for Partnership*

- Under 61 years old: The insurer is required to offer you the option to purchase and retain compound inflation protection.

- Ages 61 to 76: You must purchase and retain some form of inflation protection.

- After age 76: Insurers must offer inflation protection, but you do not have to purchase it.

* These requirements are for the new Partnership states. For the original Partnership states (CA, NY, IN, CT) check with us for more information since each state has different requirements.

* Some states have a higher Medicaid limit (MN is $3000).

Long Term Care is a family affair.

The majority of caregivers are family members.